Automate Business Finances: 10 Powerful Ways to Revolutionize Your Books

In today’s fast-paced business landscape, efficiency is paramount. Manual financial processes, once the norm, are now productivity drains, prone to errors, and time-consuming. Imagine reclaiming countless hours currently spent on data entry, reconciliation, and report generation. This is where the power of automation steps in. To truly thrive and scale, businesses must learn to automate business finances, transforming their back-office operations from a burden into a strategic asset. By embracing the right tools and techniques, companies can achieve unparalleled accuracy, gain deeper insights into their financial health, and free up valuable human resources for more strategic initiatives. This comprehensive guide will explore the top techniques for automating your business finances, delving into the specific areas ripe for transformation, the cutting-edge tools available, and a clear roadmap for successful implementation.

Why Automate Business Finances? The Undeniable Benefits

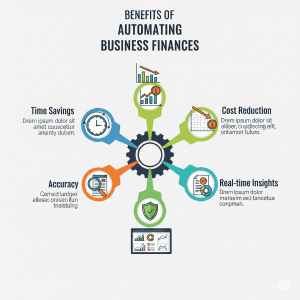

The decision to automate business finances isn’t just about adopting new technology; it’s a strategic move that delivers a multitude of tangible benefits, impacting every facet of your financial operations. Firstly, automation significantly enhances accuracy and reduces errors. Manual data entry is inherently prone to human mistakes, leading to discrepancies that can be costly and time-consuming to correct. Automated systems, on the other hand, eliminate these manual touchpoints, ensuring data is consistently and accurately recorded, from invoices to expense reports. This reduction in errors translates directly into more reliable financial statements and better decision-making.

Secondly, financial automation leads to substantial time and cost savings. Tasks like invoice processing, payroll calculation, and bank reconciliation that once consumed hours or even days can now be completed in minutes. This newfound efficiency frees up your finance team to focus on higher-value activities such as financial analysis, forecasting, and strategic planning, rather than repetitive administrative tasks. Over time, these efficiencies can drastically reduce operational costs, making your business more profitable and competitive. For instance, a small business that automates its invoicing can save dozens of hours a month, allowing them to focus on sales or product development. You can explore how automating different aspects of your operations can improve your bottom line by reading our guide on Boosting Business Efficiency with Technology.

Thirdly, automation provides real-time financial insights. Traditional manual accounting often involves looking at historical data that is days or weeks old. Automated systems continuously update your financial records, giving you an accurate, up-to-the-minute view of your cash flow, expenses, and revenue. This immediate access to critical financial data empowers business leaders to make informed, timely decisions, adapt quickly to market changes, and identify potential issues before they escalate. Imagine knowing your precise cash position at any given moment, rather than waiting for month-end reports.

Finally, automating financial processes significantly improves compliance and security. Automated systems often come with built-in audit trails, data encryption, and access controls, making it easier to comply with regulatory requirements and protect sensitive financial information from unauthorized access or fraud. This robust security infrastructure is crucial in an era of increasing cyber threats and stringent data privacy regulations. Furthermore, consistent data entry and automated checks help ensure that all transactions adhere to internal policies and external regulations, reducing the risk of penalties. Embracing financial automation solutions is no longer a luxury but a necessity for sustainable growth and operational excellence.

Key Areas Ripe for Financial Automation

When considering how to automate business finances, it’s crucial to identify the specific processes that consume the most time and are most prone to error. By targeting these areas first, businesses can achieve significant and immediate returns on their automation investment. Automation can touch almost every part of your financial workflow, from how you bill clients to how you pay your employees and vendors.

Automated Invoicing and Accounts Receivable

Manual invoicing is a tedious, error-prone process that can significantly delay cash flow. Automated invoicing systems streamline the entire cycle, from creation to collection. These systems allow businesses to create professional, branded invoices automatically based on pre-set schedules or project completion. They can then send these invoices directly to clients via email, often with options for online payment. Beyond just sending, automation tools can track invoice status in real-time, sending automated reminders for overdue payments, which dramatically reduces the need for manual follow-ups and shortens the accounts receivable cycle. Some advanced systems even offer dunning management, automatically escalating collection efforts based on pre-defined rules. This significantly improves cash flow predictability and reduces bad debt.

Streamlined Expense Management

Managing employee expenses can be a monumental task, involving stacks of receipts, manual entry, and painstaking reconciliation. Automated expense management systems revolutionize this process. Employees can simply snap a photo of a receipt with their smartphone, and the software uses OCR (Optical Character Recognition) technology to extract key data like vendor, amount, and date. Expenses are then categorized automatically, and approvals can be routed through pre-defined workflows. This eliminates manual data entry, speeds up reimbursements, and provides real-time visibility into company spending. It also significantly reduces the chances of fraudulent claims and ensures compliance with company policies, making expense management transparent and efficient. This powerful financial automation solution saves time for both employees and the finance department.

Effortless Payroll Processing

Payroll is arguably one of the most critical and complex financial processes, fraught with compliance risks if mishandled. Automating payroll ensures employees are paid accurately and on time, while also handling deductions, taxes, and regulatory filings. Modern payroll automation software integrates with time-tracking systems, automatically calculating wages, overtime, and benefits. It also manages tax withholdings, prepares and files federal, state, and local tax forms, and generates pay stubs. This not only saves immense administrative time but also minimizes the risk of costly compliance errors. Furthermore, many systems offer direct deposit capabilities and employee portals, allowing staff to access their pay information independently, reducing inquiries to HR or finance. Automated payroll is a cornerstone of efficient business operations and a key component of a robust financial automation strategy.

Optimizing Accounts Payable

Accounts payable (AP) automation transforms the process of managing vendor invoices and payments. Instead of manually entering and routing invoices for approval, AP automation solutions capture invoice data electronically (often through OCR), match it against purchase orders and receipts, and route it to the appropriate approvers based on pre-set rules. Once approved, payments can be scheduled and executed automatically, whether via ACH, wire transfer, or virtual cards. This system reduces processing costs, prevents duplicate payments, and allows businesses to take advantage of early payment discounts. It also provides a clear audit trail for every invoice, enhancing transparency and control over outgoing funds. By optimizing accounts payable, businesses gain greater control over their cash outflow and strengthen vendor relationships.

Automated Bank Reconciliation

Reconciling bank statements with your internal ledger is essential for verifying accuracy and identifying discrepancies, but it’s a notoriously time-consuming task. Automated bank reconciliation tools connect directly to your bank accounts, pulling in transaction data in real-time. The software then automatically matches these bank transactions with entries in your accounting system. For unmatched transactions, the system can often suggest matches or learn from previous categorizations, significantly reducing the manual effort required. This not only speeds up the reconciliation process but also ensures the accuracy of your cash balances, highlights potential fraud or errors quickly, and provides an up-to-date picture of your cash position. For more insights on improving cash flow, consider reading our article on Mastering Cash Flow for Small Businesses.

Essential Tools for Automating Business Finances

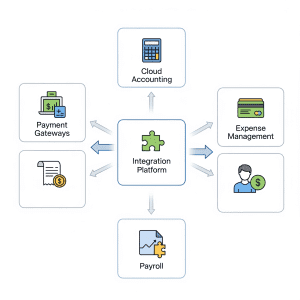

To successfully automate business finances, selecting the right technology is paramount. The market is flooded with various solutions, each designed to address specific financial processes. Understanding the core categories of these tools will help you build a cohesive and effective automation ecosystem for your business. The goal is to choose platforms that not only perform their specific function well but also integrate seamlessly with other tools you use, creating a unified flow of financial data.

Cloud-Based Accounting Software

At the heart of any modern financial automation strategy lies robust cloud-based accounting software. Platforms like QuickBooks Online, Xero, and FreshBooks serve as the central nervous system for your financial data. These solutions automate core accounting tasks such as general ledger management, financial reporting, and basic invoicing. Their cloud-based nature means you can access your financial data from anywhere, on any device, fostering greater flexibility and collaboration within your team. Key automation features include automated transaction categorization (often with AI assistance), recurring journal entries, automated reporting schedules, and seamless integration with bank accounts and credit cards for real-time data feeds. The ability to connect with other financial tools, such as payroll or expense management systems, is often a major strength of these platforms, making them indispensable for companies looking to streamline financial operations. Choosing the right cloud accounting software is the foundational step towards comprehensive financial automation.

Payment Gateways and Online Processors

Efficiently collecting payments is crucial for any business, and payment gateways and online processors play a pivotal role in automating this process. Services like Stripe, PayPal, Square, and Braintree enable businesses to accept online payments securely and instantly. They integrate directly with your invoicing software, e-commerce platforms, or CRM systems, allowing customers to pay with credit cards, debit cards, or digital wallets at the click of a button. Automation here extends beyond just receiving payments; these systems also automatically record transactions in your accounting software, issue digital receipts, and often handle recurring billing for subscriptions. This eliminates manual payment processing, reduces administrative burden, and significantly speeds up cash collection, enhancing your cash flow management. The security features built into these platforms also protect against fraud and ensure PCI compliance, adding another layer of automation in risk management.

Data Integration and Workflow Automation Platforms

While individual tools handle specific tasks, true end-to-end financial automation often requires seamless data flow between disparate systems. This is where data integration and workflow automation platforms become essential. Tools like Zapier, Integrately, and Microsoft Power Automate act as connectors, allowing different software applications to “talk” to each other without manual intervention. For example, you can set up a “zap” that automatically creates a new customer record in your accounting software whenever a new sale is made in your CRM, or automatically generate an invoice when a project is marked as complete in your project management tool. These platforms enable you to build custom automated workflows, eliminating redundant data entry, ensuring data consistency across systems, and orchestrating complex financial processes. By connecting your sales, marketing, operations, and finance systems, you can achieve a holistic view of your business and truly streamline financial operations from end to end, unlocking deeper levels of efficiency.

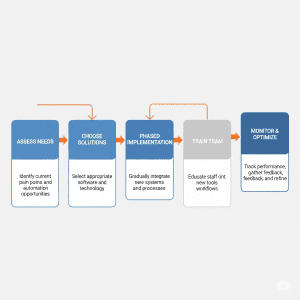

Implementing Financial Automation: A Step-by-Step Roadmap

Successfully integrating financial automation into your business requires more than just purchasing software; it demands a strategic, phased approach. Rushing into implementation without proper planning can lead to inefficiencies, resistance from staff, and ultimately, a failure to realize the full benefits of automation. This roadmap provides a clear path to help you automate business finances effectively and transition smoothly to a more efficient financial operation. Remember, the goal is not just to replace manual tasks but to fundamentally improve your financial workflows.

Assess Current Processes and Identify Pain Points

Before you can automate, you must understand what you’re automating. Begin by conducting a thorough audit of your existing financial processes. Map out every step involved in tasks like invoicing, expense reporting, payroll, and bank reconciliation. Identify bottlenecks, areas prone to human error, and time-consuming manual interventions. Talk to your team members who are directly involved in these processes; they often have invaluable insights into where inefficiencies lie. Ask questions such as: “Where do we spend the most time on repetitive data entry?” or “What financial tasks consistently cause delays or errors?” This initial assessment will help you pinpoint specific pain points and determine which areas will yield the greatest return on investment from automation. Without a clear understanding of your current state, you risk automating inefficiency rather than improving it.

Research and Choose the Right Solutions

Once you’ve identified your pain points, the next step is to research and select the appropriate automation tools. This isn’t a one-size-fits-all decision; the best solutions will depend on your business’s size, industry, specific needs, and budget. Look for software that directly addresses your identified pain points. For example, if expense reporting is a major issue, focus on dedicated expense management software. Prioritize solutions that offer robust features, strong security protocols, and, crucially, seamless integration capabilities with your existing accounting software and other business systems. Read reviews, request demos, and don’t hesitate to contact vendors with specific questions. Consider scalability – will the chosen solution grow with your business? This thorough research ensures you invest in tools that truly help you automate business finances efficiently.

Plan a Phased Implementation

Attempting to automate everything at once can be overwhelming and disruptive. A phased implementation approach is generally more successful. Start with one or two key areas that offer the clearest benefits and are relatively straightforward to automate, such as invoicing or expense reporting. This allows your team to get accustomed to the new systems and processes without being inundated. Once these initial automations are running smoothly, you can gradually introduce additional automated workflows. This iterative approach minimizes disruption, allows for lessons learned from early phases to be applied to subsequent ones, and builds confidence within your organization. Each successful phase provides a strong foundation for the next, ensuring a smoother transition and greater overall adoption of the new financial automation solutions.

Train Your Team

Technology is only as effective as the people using it. Comprehensive training for your finance team and any other employees who will interact with the new automated systems is critical. Don’t assume your team will intuitively understand the new software. Provide hands-on training sessions, create detailed user guides, and offer ongoing support. Explain not just how to use the new tools but also *why* these changes are being made and how they will benefit the team and the company. Address any concerns or resistance proactively. Engaged and well-trained employees are essential for maximizing the benefits of financial automation and ensuring a smooth transition. Invest in their learning, and they will become advocates for the new processes, driving widespread adoption.

Monitor, Analyze, and Optimize

Implementation is not the end of the journey; it’s just the beginning. Continuously monitor the performance of your automated financial processes. Track key metrics such as time saved, error rates, processing speed, and compliance adherence. Gather feedback from your team regularly. Are there still bottlenecks? Are new issues arising? Use this data to analyze what’s working well and what needs improvement. Automation is an ongoing process of refinement. Be prepared to make adjustments, explore new features of your chosen software, or even consider integrating additional tools as your business evolves. Regular optimization ensures that your financial automation strategy remains aligned with your business goals and continues to deliver maximum value, keeping your operations lean and efficient. This iterative improvement is crucial to truly automate business finances effectively.

Overcoming Common Challenges in Automation

While the benefits of automating business finances are clear, the path to implementation isn’t always smooth. Businesses often encounter several common challenges that can hinder progress if not addressed proactively. One significant hurdle is **initial resistance to change** from employees. Staff members, accustomed to traditional manual processes, might fear job displacement, perceive the new systems as complex, or simply be comfortable with the status quo. To overcome this, clear communication is vital. Explain the ‘why’ behind the automation, highlighting how it will free them from tedious tasks, enhance their roles, and make their jobs more strategic and less repetitive. Involve them in the planning and training phases, making them feel part of the solution rather than just recipients of change. A gradual rollout, as discussed in the implementation roadmap, can also help ease this transition.

Another common challenge is **data migration and integration complexity**. Moving historical financial data from old systems or spreadsheets to new automated platforms can be a daunting task, fraught with potential for data loss or corruption. Furthermore, ensuring seamless integration between different software solutions (e.g., accounting software, CRM, payroll) requires careful planning and often technical expertise. It’s crucial to invest time in data cleansing before migration and to thoroughly test all integrations before going live. Partnering with IT professionals or solution providers who specialize in data migration can significantly mitigate these risks. Don’t underestimate the time and resources required for this critical phase; a botched data migration can undermine the entire automation effort. Read more about Data Migration Best Practices for Businesses to ensure a smooth transition.

Finally, **cost justification and ROI measurement** can be challenging. While automation promises long-term savings, the upfront investment in software, training, and potential consulting services can be substantial. Businesses need to clearly define and track key performance indicators (KPIs) to demonstrate the return on investment (ROI). This includes tracking time saved, error reduction rates, faster cash collection cycles, and improved compliance. Presenting a compelling business case backed by projected savings and efficiency gains will secure executive buy-in and justify the initial outlay. It’s not just about direct cost savings; consider the indirect benefits like improved employee morale, better decision-making from real-time data, and enhanced scalability. Addressing these challenges head-on will ensure your efforts to automate business finances yield the desired results.

The Future of Financial Automation: AI and Beyond

The landscape of financial automation is continuously evolving, with emerging technologies poised to revolutionize how businesses manage their money. At the forefront of this evolution is **Artificial Intelligence (AI) and Machine Learning (ML)**. AI is already transforming financial processes by enabling more sophisticated automation beyond simple rule-based tasks. For instance, AI-powered accounting software can learn from past transactions to automatically categorize complex expenses with greater accuracy, detect anomalies or potential fraud patterns, and even predict future cash flow with surprising precision. ML algorithms can analyze vast datasets to identify spending trends, optimize purchasing decisions, and provide proactive insights into financial health, moving financial reporting from descriptive to prescriptive.

Beyond AI, **Robotic Process Automation (RPA)** is gaining traction for automating highly repetitive, rule-based tasks that often span multiple applications. RPA bots can mimic human actions to log into systems, extract data, input information, and process transactions, essentially acting as virtual employees for mundane financial tasks. This is particularly useful for areas like vendor onboarding, invoice processing with complex rules, or managing large volumes of customer inquiries related to billing. RPA can bridge the gaps between legacy systems that don’t have direct API integrations, allowing for automation where it previously wasn’t possible. The combined power of AI and RPA promises to create hyper-automated financial operations that are self-learning and self-correcting.

Another significant trend is the rise of **blockchain technology** for enhanced transparency and security in financial transactions. While still in its early stages for mainstream financial automation, blockchain could revolutionize areas like intercompany reconciliation, supply chain finance, and audit trails by providing an immutable, distributed ledger of transactions. Furthermore, the increasing adoption of **Open Banking APIs** is fostering greater connectivity between banks, accounting software, and financial apps, enabling real-time data exchange and a more holistic view of a company’s financial standing. These future trends suggest that businesses will not just automate individual tasks but will move towards intelligent, integrated, and predictive financial management systems, making it even more imperative for businesses to proactively plan how to automate business finances and stay ahead of the curve.

Quick Takeaways

- Embrace Automation for Growth: Automating business finances is crucial for accuracy, efficiency, and real-time insights, allowing businesses to scale and compete effectively.

- Target Key Areas: Focus on automating invoicing, expense management, payroll, accounts payable, and bank reconciliation for significant immediate gains.

- Invest in the Right Tools: Utilize cloud-based accounting software, payment gateways, and data integration platforms to create a seamless financial ecosystem.

- Follow a Strategic Roadmap: Assess needs, choose solutions wisely, implement in phases, thoroughly train your team, and continuously monitor for optimization.

- Address Challenges Proactively: Manage resistance to change, plan for data migration complexities, and clearly articulate ROI to ensure successful adoption.

- Look to the Future: Stay abreast of emerging technologies like AI, RPA, and blockchain, which will further transform financial automation capabilities.

- Continuous Improvement: Financial automation is an ongoing journey; regularly review and refine your processes to maintain peak efficiency.

The journey to automate business finances is a transformative one, moving your organization from reactive to proactive financial management. By embracing the techniques and tools outlined in this guide, you’re not just saving time; you’re building a more resilient, agile, and insightful financial backbone for your entire enterprise. The initial effort invested in planning and implementing these automations will pay dividends for years to come, enabling your business to focus on innovation, customer satisfaction, and strategic growth rather than getting bogged down in administrative minutiae. Take the first step today towards a smarter, more efficient financial future. Ready to streamline your operations and unlock new levels of financial clarity? Contact a financial automation specialist to assess your needs and kickstart your transformation.

Frequently Asked Questions About Financial Automation

How do I start to automate financial processes in a small business?

For small businesses, begin by identifying the most time-consuming or error-prone financial tasks, such as invoicing or expense tracking. Then, research user-friendly cloud accounting software like QuickBooks Online or Xero, which often include built-in automation features. Start with one area, implement the tool, train your team, and then gradually expand to other processes like payroll automation. Focusing on small wins builds momentum and confidence.

What are the biggest benefits of using automated accounting software?

Automated accounting software offers numerous benefits, including significantly increased accuracy by reducing manual data entry errors, substantial time savings in reconciliation and reporting, real-time financial insights for better decision-making, and improved compliance with tax regulations due to automated calculations and filings. It also streamlines financial operations, freeing up staff for more strategic work.

Can financial automation help prevent fraud?

Yes, financial automation can significantly enhance fraud prevention. Automated systems create detailed audit trails for every transaction, making it easier to track and identify suspicious activity. Many tools also incorporate built-in controls, such as automated matching of invoices to purchase orders and receipts, and role-based access permissions, which reduce opportunities for internal or external fraud. AI and ML are increasingly used to detect anomalous patterns indicative of fraudulent behavior.

Is it expensive to automate business finances?

The initial investment to automate business finances can vary, depending on the scope and complexity of the solutions chosen. Cloud-based accounting software often has affordable monthly subscriptions, while more comprehensive ERP systems can be a larger upfront cost. However, the long-term return on investment (ROI) typically far outweighs these costs through significant savings in labor, error correction, and improved efficiency, leading to higher profitability and scalability.

How long does it take to fully automate a business’s finances?

The timeline for fully automating a business’s finances varies widely based on the size and complexity of the business, and the extent of automation desired. Small businesses focusing on core areas might see significant automation benefits within a few months. Larger enterprises with complex systems and multiple integrations could take 6-12 months or even longer for a full transformation. A phased implementation approach is recommended to manage expectations and ensure success over time.

We hope this comprehensive guide has provided valuable insights into the world of financial automation. What are your biggest challenges when it comes to managing business finances? Share your thoughts and experiences in the comments below – your insights could help other businesses on their automation journey!